The financial instability hypothesis of Hyman Minsky was a key part of 2008's financial crisis. But what were his theories? And how did they impact the current global economic crisis and 2008's financial crisis? We will be looking at the Minsky-Moment, Financial instability and the Financial instability hypothesis. The implications of the theory for the global economic system will be addressed. This article will prepare you to talk to financial advisors about the future and financial markets.

Hyman Minsky

Hyman Minsky was an American economist. He lived from 1919 until 1996. He was an assistant at Alvin Hansen's Harvard University and University of Chicago, where he studied economics. Minsky was a Harvard professor during his time. He taught at Brown, Carnegie-Mellon and Berekely. He took up a position at Washington University in 1965. Hyman Minsky's theory of financial instability, which he published in his book Stabilizing an unstable Economy, is his most famous work.

Financial instability hypothesis

Financial instability hypothesis suggests that the world would see higher growth and lower unemployment if it were to eliminate extreme price fluctuations. Minsky believes that there are certain elements of the capitalist model that cause extreme price fluctuation. Minsky argues, among other things that inflation is caused by the need to bail out financially troubled institutions. Furthermore, he argues that there is no magical solution to financial instability.

Minsky moment

Minsky Moment is an abrupt and severe collapse in asset value, which usually signals the end to a boom or bubble in one market. The amount of bullish speculation during the recent period is indicative of the severity and duration of the crisis. Many will demand a "new beginning" when this happens. While others will praise the end the economic cycle, some will be critical. The important question here is how we can avoid another Minsky moment.

2008 Financial crisis

Hyman Minsky, an economist of international repute, received his Ph.D. degree from Harvard. He has taught at Harvard, Berkeley University, and Washington University. He was the former director at the Mark Twain Bank, St. Louis. Minsky devised a model of credit cycles that includes five stages: euphoria (profit taking), panic, displacement, and panic. These stages are triggered when there is an abrupt change in economic policy.

Minsky moment: Economic theory behind it

The Minsky Moment was a crucial turning point in 2008's subprime mortgage crisis. Easy credit access allowed households to accumulate debt, and asset values rose. The unsustainable bullish speculation led to the collapse of the US economy. In mid-2006, housing prices started to fall and were then wiped out in the Great Recession of 2008.

Minsky cycle and global economy

Minsky's cycle is a theoretical model that tracks changes in financing arrangements. This can lead to increased risk-taking. Hedge financing is a form of finance that relies on the expectation of high revenues to repay the loan principal. The second phase of the cycle is called speculative financing, in which the lenders use the capital gains they make to pay off their debt obligations.

FAQ

What can you do with AI?

AI serves two primary purposes.

* Prediction - AI systems can predict future events. AI can help a self-driving automobile identify traffic lights so it can stop at the red ones.

* Decision making. AI systems can make important decisions for us. For example, your phone can recognize faces and suggest friends call.

How will governments regulate AI

Governments are already regulating AI, but they need to do it better. They need to make sure that people control how their data is used. They must also ensure that AI is not used for unethical purposes by companies.

They also need to ensure that we're not creating an unfair playing field between different types of businesses. Small business owners who want to use AI for their business should be allowed to do this without restrictions from large companies.

What are the potential benefits of AI

Artificial Intelligence is a revolutionary technology that could forever change the way we live. Artificial Intelligence has revolutionized healthcare and finance. It's also predicted to have profound impact on education and government services by 2020.

AI is already being used for solving problems in healthcare, transport, energy and security. As more applications emerge, the possibilities become endless.

What is the secret to its uniqueness? It learns. Computers can learn, and they don't need any training. Instead of being taught, they just observe patterns in the world then apply them when required.

AI is distinguished from other types of software by its ability to quickly learn. Computers can scan millions of pages per second. They can instantly translate foreign languages and recognize faces.

And because AI doesn't require human intervention, it can complete tasks much faster than humans. It can even outperform humans in certain situations.

2017 was the year of Eugene Goostman, a chatbot created by researchers. The bot fooled many people into believing that it was Vladimir Putin.

This is proof that AI can be very persuasive. Another benefit of AI is its ability to adapt. It can also be trained to perform tasks quickly and efficiently.

Businesses don't need to spend large amounts on expensive IT infrastructure, or hire large numbers employees.

How do you think AI will affect your job?

AI will eliminate certain jobs. This includes drivers of trucks, taxi drivers, cashiers and fast food workers.

AI will create new employment. This includes jobs like data scientists, business analysts, project managers, product designers, and marketing specialists.

AI will make existing jobs much easier. This includes doctors, lawyers, accountants, teachers, nurses and engineers.

AI will improve the efficiency of existing jobs. This includes customer support representatives, salespeople, call center agents, as well as customers.

Who created AI?

Alan Turing

Turing was first born in 1912. His father was a clergyman, and his mother was a nurse. He was an exceptional student of mathematics, but he felt depressed after being denied by Cambridge University. He learned chess after being rejected by Cambridge University. He won numerous tournaments. He was a British code-breaking specialist, Bletchley Park. There he cracked German codes.

He died in 1954.

John McCarthy

McCarthy was born on January 28, 1928. He studied maths at Princeton University before joining MIT. There he developed the LISP programming language. He had already created the foundations for modern AI by 1957.

He died on November 11, 2011.

Where did AI originate?

Artificial intelligence began in 1950 when Alan Turing suggested a test for intelligent machines. He stated that intelligent machines could trick people into believing they are talking to another person.

John McCarthy took the idea up and wrote an essay entitled "Can Machines think?" in 1956. He described the difficulties faced by AI researchers and offered some solutions.

What is the role of AI?

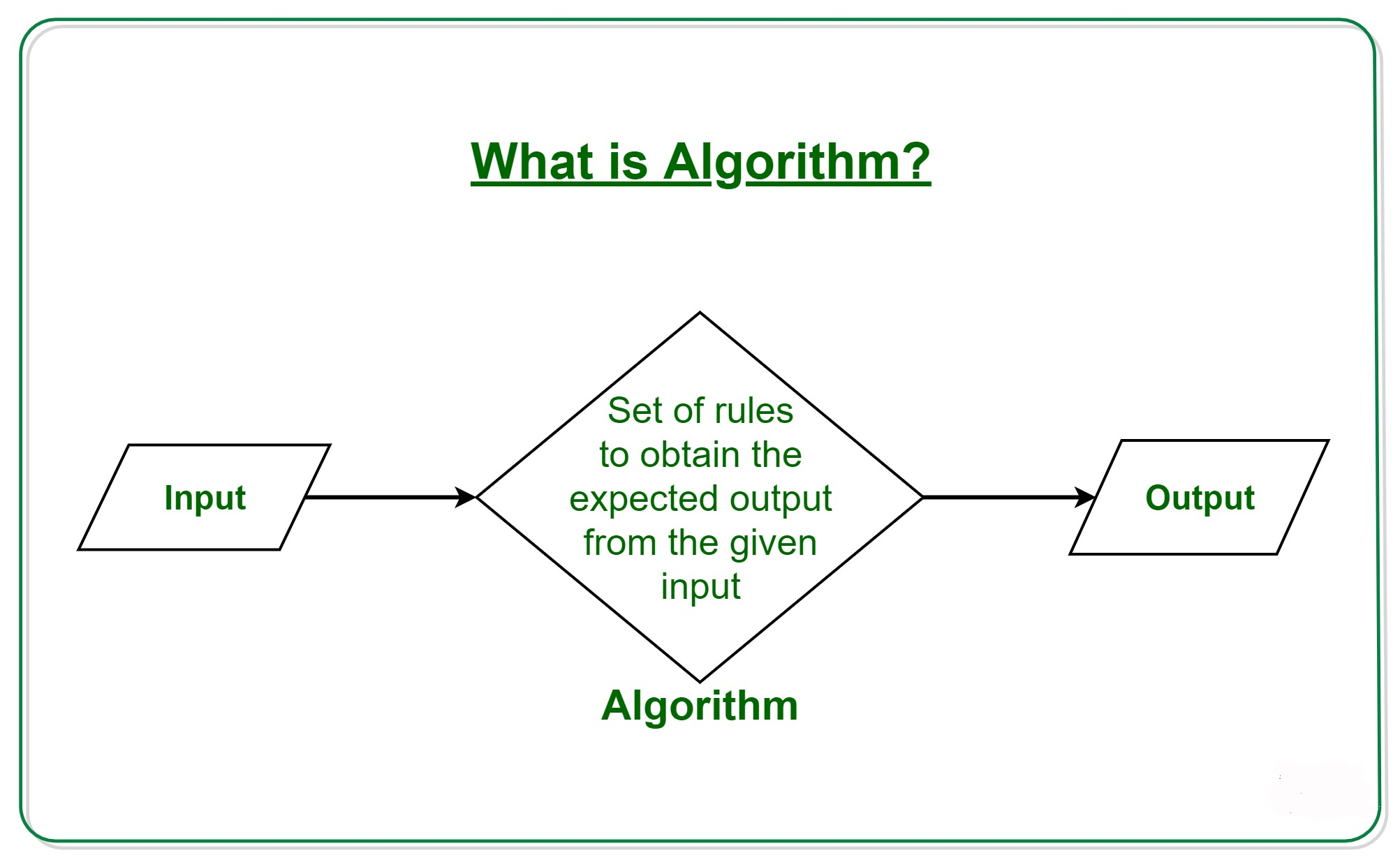

An algorithm is a sequence of instructions that instructs a computer to solve a problem. An algorithm can be expressed as a series of steps. Each step has a condition that determines when it should execute. Each instruction is executed sequentially by the computer until all conditions have been met. This repeats until the final outcome is reached.

For example, suppose you want the square root for 5. If you wanted to find the square root of 5, you could write down every number from 1 through 10. Then calculate the square root and take the average. You could instead use the following formula to write down:

sqrt(x) x^0.5

This means that you need to square your input, divide it with 2, and multiply it by 0.5.

This is the same way a computer works. It takes your input, multiplies it with 0.5, divides it again, subtracts 1 then outputs the result.

Statistics

- Additionally, keeping in mind the current crisis, the AI is designed in a manner where it reduces the carbon footprint by 20-40%. (analyticsinsight.net)

- More than 70 percent of users claim they book trips on their phones, review travel tips, and research local landmarks and restaurants. (builtin.com)

- The company's AI team trained an image recognition model to 85 percent accuracy using billions of public Instagram photos tagged with hashtags. (builtin.com)

- In the first half of 2017, the company discovered and banned 300,000 terrorist-linked accounts, 95 percent of which were found by non-human, artificially intelligent machines. (builtin.com)

- While all of it is still what seems like a far way off, the future of this technology presents a Catch-22, able to solve the world's problems and likely to power all the A.I. systems on earth, but also incredibly dangerous in the wrong hands. (forbes.com)

External Links

How To

How do I start using AI?

A way to make artificial intelligence work is to create an algorithm that learns through its mistakes. This learning can be used to improve future decisions.

For example, if you're writing a text message, you could add a feature where the system suggests words to complete a sentence. It would analyze your past messages to suggest similar phrases that you could choose from.

However, it is necessary to train the system to understand what you are trying to communicate.

Chatbots can also be created for answering your questions. For example, you might ask, "what time does my flight leave?" The bot will respond, "The next one departs at 8 AM."

Take a look at this guide to learn how to start machine learning.